Following the Chancellor’s Autumn 2022 Budget, there will be changes to Capital Gains Tax (CGT) allowances from April 2023 when selling UK property under certain circumstances, notes Malcolm Ellison, a Tax Adviser at Tallents Solicitors.

Malcom Ellison, tax adviser at Tallents Solicitors

This could significantly increase tax bills for second homeowners, landowners and landlords selling property, as the amount you can earn before paying tax will be cut to a quarter of the current amount over the next two years.

What is Capital Gains Tax and when would I pay it on a property sale?

CGT is payable on the profits made when selling buy-to-let property or a second home. It may also be due if you are selling a home which is also used as business premises, or if you lease out part of the property to a tenant. CGT may also be payable on inherited property. Individual circumstances will vary, so it’s recommended to seek advice before taking any action.

You will not pay CGT when selling your main residence, provided you have always lived there and you sell it within 9 months of leaving the property.

What are the changes to CGT for property sales?

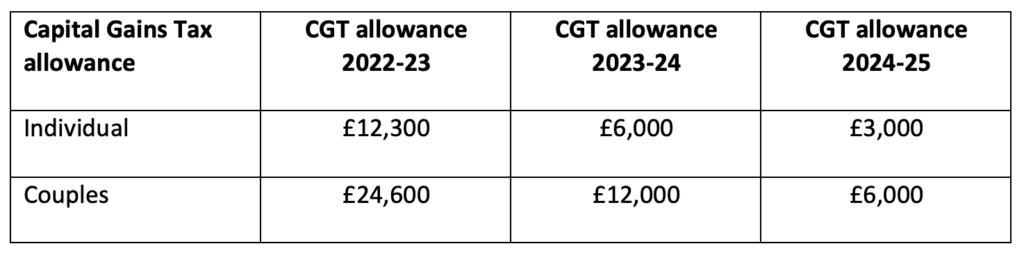

The annual CGT allowance will be halved for the tax year 2023-24 and then halved again in 2024-25.

As property is a valuable asset, the chances of a significant financial gain is very high when the property is sold. As the CGT allowances are reduced, the government expects many more people to become liable for CGT payments.

Married couples and civil partners can transfer assets to each other without incurring CGT, so it is possible to double an individual’s annual allowance to take advantage of the extra relief.

Additionally, certain losses made in each tax year can be offset against gains and possibly result in a smaller CGT bill payable.

Is the rate of CGT changing?

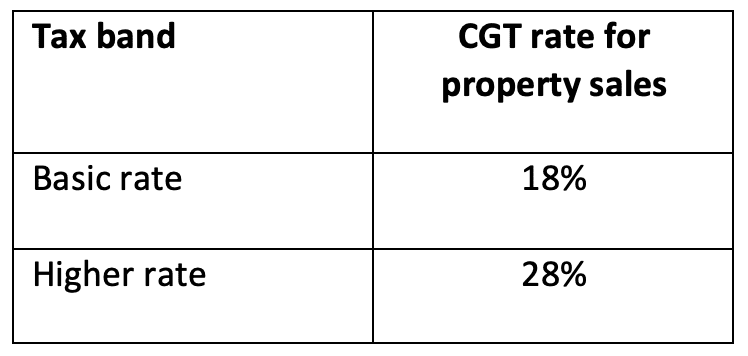

Malcolm notes that the tax rate for CGT isn’t changing, just the allowances are.

However, there are different rates of tax payable, depending on whether you are a basic rate taxpayer, or if you pay tax at a higher rate.

Other CGT tax rates do apply on the sale of other assets, such as investments or antiques, and other valuable assets.

How do I know how much CGT I need to pay on a property sale?

The gain you made on the property sale will be the difference between what you paid for it and the amount you received when you sold, or disposed, of it. If this amount, when added to your other income is more than your allowance for the year, then you will have to report and pay CGT.

You can deduct costs for buying, selling or improving your property from the gain you made from the property, including: solicitor and estate agent’s fees, or significant improvement works, such as an extension. Regular maintenance to the property cannot be deducted as costs.

What happens if I need to pay CGT on property?

Unlike other CGT, which can be reported in your end of year tax return, CGT incurred on property must be reported and paid within 60 days of the property sale completion.

If unsure, seek advice from the experts

Malcolm finishes, Capital Gains Tax can be complicated to figure out. It’s important to know when CGT is due on a property sale and, depending on your circumstances, whether any tax reliefs can be applied to reduce the CGT bill due.

Here at Tallents Solicitors, we have experts who deal with the sale and disposal of property and valuable assets every day. Staff in our Conveyancing and Private Client departments will be more than happy to have a confidential discussion with you regarding your circumstances. Please call us on 01636 671881.